Annual Report 2024/25

- Christian Evans

- Sep 13, 2025

- 2 min read

Updated: Nov 8, 2025

To start the annual report I want to define more precisely what I want the purpose of this blog to be. This blog will best serve me as an online investing journal and a tool to document my learning. It is not meant to be a place that forces me to publish research at each quarter. I find this has added stress to my life and made the portfolio less rewarding. Henceforth, this will serve as a place to get my thoughts down as an investor. With that being said, let's look at performance.

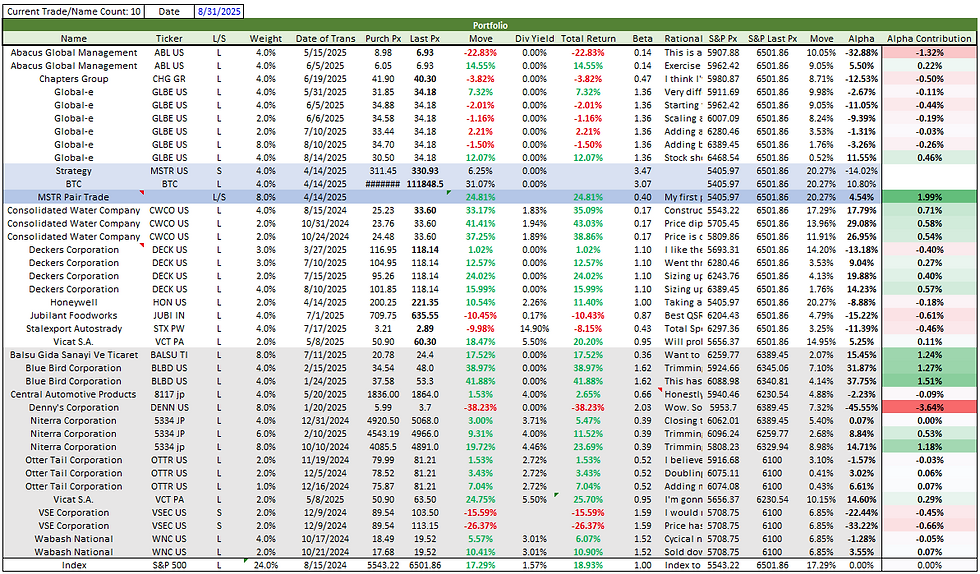

The following is my portfolio for the year ended August 31, 2025:

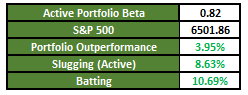

The following is my performance:

The year ended with some strong performance in August which helped me close out my first year beating the market as an investor! Hopefully it's a streak that continues for the rest of my life (wishful thinking). August performance was due to recoveries in BLBD and DECK along with some continued great performance from the MSTR pair trade.

I'm doing a purge of the portfolio. I want to own ideas that I have underwritten and have high conviction in. That means that I will not own any name that I haven't modeled in one way or another. I also will not own names at less than a 5% weight. If I'm not willing to swing big than why swing at all. I'm going to invest in my best ideas at concentrated weights. Ideally I would own 7 names at a given time.

September and October will serve as a transition period into this ideal portfolio. I'm going to work on Consolidated Water and Vicat and STX PW to see if they belong. The other nominal Grandeur weights are out the door. I'm going to stick around for another earnings with ABL and JUBI because I think they're asymmetric. Honeywell is gone.

Looking forward to another year of investing! I really feel like I'm getting better with each month that passes and am so grateful to have found something so intellectually stimulating.

Comments