Initiating Coverage on Denny's Corporation (DENN US: Model)

- Christian Evans

- Feb 3, 2025

- 4 min read

Updated: Feb 18, 2025

Date of Initiation: 1/13/2025

Price Target: $8.08

Conviction: 6/10

Holding Period: 2 Years

Denny's was an idea I pulled out when doing a top-down analysis of the fast food and casual dining restaurant value chain. Denny's met my screening criteria in that it has high ROIC and is trading at a discount relative to its historical value. My two peers and I worked on Denny's for a stock pitch competition, and I spent most of my time in the model. With that being said, most of my thoughts on why Denny's is a good investment come from a top-down approach to the industry and my realizations while building the model.

When looking at Denny's five-year stock performance, you can see it got absolutely hammered coming out of COVID. Consumer foot traffic at Denny's and similar family-style restaurants fell off a cliff. Furthermore, inflation forced Denny's to raise prices and further ostracize a market they previously had. The value proposition of Denny's is not what it once was; I fully realize that. Consumers opting for convenience or price will head to fast-casual dining restaurants. Consumers looking for value will head to fast-food chains. And with fewer and fewer Americans opting for the sit-down dining experience, I completely understand that Denny's is operating in a market experiencing secular decline.

However, I argue that Denny's fundamentals are not 70% worse than they were pre-COVID, which is implied by the stock's performance. Are things worse? Certainly. But they are not 70% worse. Here are some reasons I think that's the case. The table below shows my estimates next to consensus estimates. You'll notice I'm at or below consensus on essentially every measure except FCF, which I believe shows that the stock is unfairly trading off negative sentiment. I believe that this Denny's pitch has a duration advantage compared to the rest of the market.

Real Estate

Denny's owns a sizable portion of its real estate. Since this land is recorded at historical cost, it's hard to ascertain how much land they actually own. The dollar amount has stayed within $25–60 million on the balance sheet since 2003.

In conversations with more seasoned investors, they feel that ownership of the land is crucial for the financial health of these restaurant chains. Peter Lynch writes about certain investments he has made being pure asset plays. Because I am not confident in the fair market value of Denny's real estate, I can't confidently say this is an asset play. But it's certainly a point in Denny's favor that they've maintained a steady amount of land on their balance sheet for as far back as I can source the data.

Closing the Worst, Opening the Best

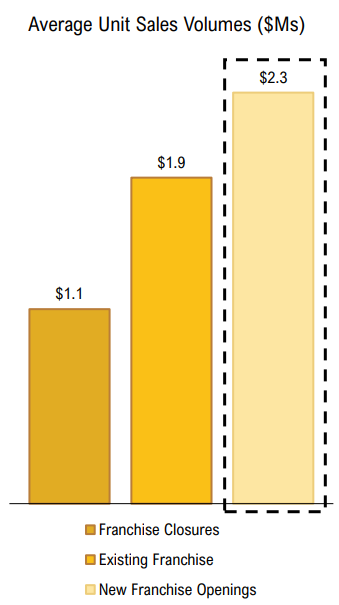

Denny's management has implemented a turnaround plan that includes closing down the worst-performing locations and opening newer, higher-performing locations. The average unit volume (AUV) of a store closed is $1.1 million. Compare this to the AUV of a new franchise, which comes in at $2.3 million, and you'll see that they are having success in identifying new locations and weeding out the worst. They plan on continuing these closures through FY2025 and hope to have a solid base of performing stores at year-end.

These closures will contribute to an increase in AUV and same-store sales (SSS) growth across the company's restaurant base.

Keke's Growth Potential

Denny's acquired upscale breakfast chain Keke's in 2022. This brand has seen nice growth and is looking to meaningfully expand outside of Florida moving forward. While I haven't put much thought into a Keke's forecast, I think the market is undervaluing its potential. The 61 current stores prove that customers like the model, and certain food chains similar to Keke's demand multiples that make you wince.

Risks

The main risk I see with an investment in Denny's concerns a bankruptcy. The company is about 5.5x net debt/EBITDA, which is far more leveraged than I would normally touch. I have had conversations with better investors around me who reason that the franchise model can withstand more debt than most other business models, but it is still concerning to me that the debt levels are this high.

Furthermore, there have been some headline-making bankruptcies in this space very recently. Both TGI Fridays and Red Lobster have dealt with their fair share of financial troubles over the last year. As I understand the Red Lobster bankruptcy, they enacted some sale-leasebacks that were detrimental to the company in a downturn and ultimately led to the chain's demise. This is not something that Denny's has done, but I still fear that the downside risk here is essentially 100%.

Conclusion

My Denny's thesis is much less organized than my OTTR thesis or Niterra thesis, which is something I am perfectly okay with. I simply think there are too many positives in the fundamentals of Denny's to write it off as dead. An investment in Denny's is an opportunity to capitalize on overly negative sentiment surrounding family-style restaurant brands. Denny's has a loyal following of customers, and I can't imagine it going out of business or dropping below a store count of 1,200. I will monitor this very closely and attempt to do a better job formulating theses as the coverage plays out.

Comments