Portfolio Update: February 2025

- Christian Evans

- Feb 19, 2025

- 3 min read

I'm going to begin writing up my thoughts on the portfolio in the main blog each month. I feel that putting it on a separate page has no benefits.

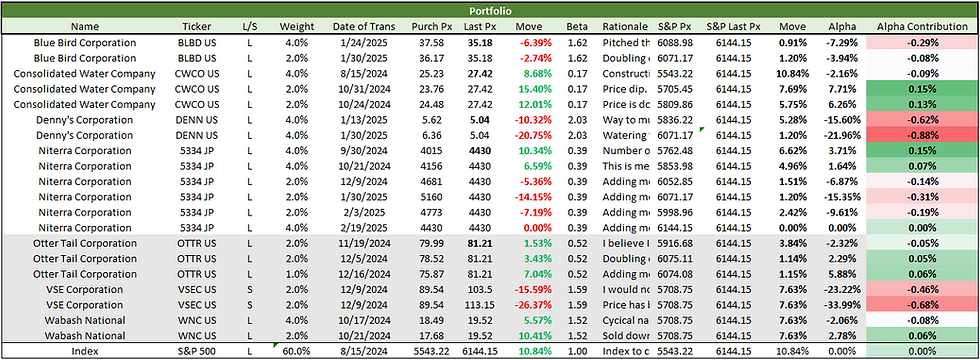

The following is my portfolio as of 2/19/2025:

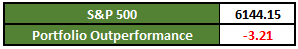

And the following is my outperformance against the S&P 500:

Obviously it has been a tough month. I went from around a point of outperformance to underperforming the bench by more than three points. In many of the books I've read, the best investors will talk about how times of bad performance had them questioning the companies they own and if they are cut out for the job. I'm definitely feeling some of that right now. I have taken a hard look at all that I own and am trying to evaluate the merits of my style. I seem to favor traditional value investing, with no company I own trading at a p/e above 20x. I also seem to favor Industrials and Consumer names, and have no holdings in any other sector. This is a function of me staying in my circle of competence and the stage of development that I am in. I think it's very easy to understand a lot of Industrial and Consumer companies, but it might be smart from a diversification standpoint to own outside of these sectors. The low valuation of my portfolio I attribute to the ease of understanding value investing. I think valuation is incredibly important, but I think my attraction to really low valuations will cause me to miss out on names that are fairly priced but compounding earnings at a rate that makes them mispriced.

One of the investors at Grandeur that I admire told me something a week ago that has been ringing in my head nonstop. He said that the best portfolios or funds have "multiple paths to victory". He explained that if you are invested in one theme or only invest in one kind of story, then you will suffer mightily when your style is out of favor or your kind of company is underperforming. He explained that one of the great portfolios he got to work on had turnarounds, fallen angels, yield plays, contrarian plays, GARPy names, and growth companies all under one roof. This diversification of style and ownership allowed the fund to outperform the benchmark consistently because the odds that one of these styles is out of favor is high, but the odds that all of these styles are out of favor is very low.

I look at my portfolio right now and think there's really only one way this can win. All of the stocks I own are value plays with similar theses. The thesis that the market has wrongfully put a discount on a solid asset that is experiencing some negative sentiment in the near term seems to apply to everything I own. To expand my abilities as an investor, I need to add names that help the portfolio have many paths to victory. I'll begin looking for some GARPy names to stretch my style and help diversify my holdings.

It's also worth noting that I sold out of Otter Tail with the rationale that the Plastics hyper-fixation thesis was largely realized at full-year earnings. Plastics guidance for 2025 was overwhelmingly positive, and I think the market now knows that plastics will have a slower decline than initially anticipated. That means that the only reason to hold would be in hopes of data centers moving to North Dakota. This is not a bet I feel I can substantiate or have an edge on, so I feel it best to sell. The position will end with some small outperformance, and for a stock with 0.52 beta I'm sure this had some positive alpha generation.

I have also done some thinking on the Denny's position, and am a little worried I am trying to catch a falling knife. I walked a colleague at Grandeur through the thesis and they told me the following joke: "What's a stock that was down 90%?... A stock that was down 80% but got cut in half." Peter Lynch says that stock's can always get worse, and I think I went into the Denny's position with a "this can't get much worse mindset" which is actively being proven wrong. I am not planning on selling. I just wish I had done more work at the inception of the position to really solidify a thesis instead of spending so much time building a confusing model. Certainly a learning experience.

Comments