Portfolio Update: January 2026

- Christian Evans

- 1 day ago

- 3 min read

The following is my active portfolio as of market close 2/6/2026:

Here is my portfolio outperformance at market close on 2/6/2026:

And alpha by active position at market close 2/6/2026:

Another month, another headache (this has been one of my favorite months investing to date, I'm being facetious). Truthfully it's just been this last week that has been difficult. I had somewhere around 4-5pps of alpha at close on Friday, January 30th. The software selloff hit me hard, and so I'm almost even with the market as of writing. GLBE has been the major detractor this last month. It went from 89bps of outperformance to 458bps of underperformance. I get another card from them in two weeks now, but am seriously dumbfounded. The market seems to be grouping GLBE into the software basket. It is classified as "Application Software" on Bloomberg. But anyone that knows the business model knows that software is not their value proposition. I'm hoping a good report from MORN and GLBE will help reverse course on some of these "software" names. DECK and AFRM have been bright spots, which is nice considering they are the two companies that have reported so far.

I've taken a position in PayPoint (materials should be posted by the time you read this) at 20% of the portfolio. I'm really excited about this name, the margin of safety seems remarkably high. I'm clearly swinging big on this name, but I think this is maybe the best risk/reward I've seen on a name in my entire 18 months of doing this. I didn't make any other transactions this month, but I expect Abacus Global and the AFRM/KLAR pair trade to be closed by the next time I write. I also think I'll add Trend Micro, a Japanese Cybersecurity firm. I want Japan exposure but I am worried about the AI risk inherent in a name like this. While I think enterprise cybersecurity is defensible, I've been shown in these last 5 days that I have a lot of exposure to AI exposed names. I will likely fund incremental longs with the Abacus weight and weight from a short on Lovesac, which is research I'm conducting for a case competition.

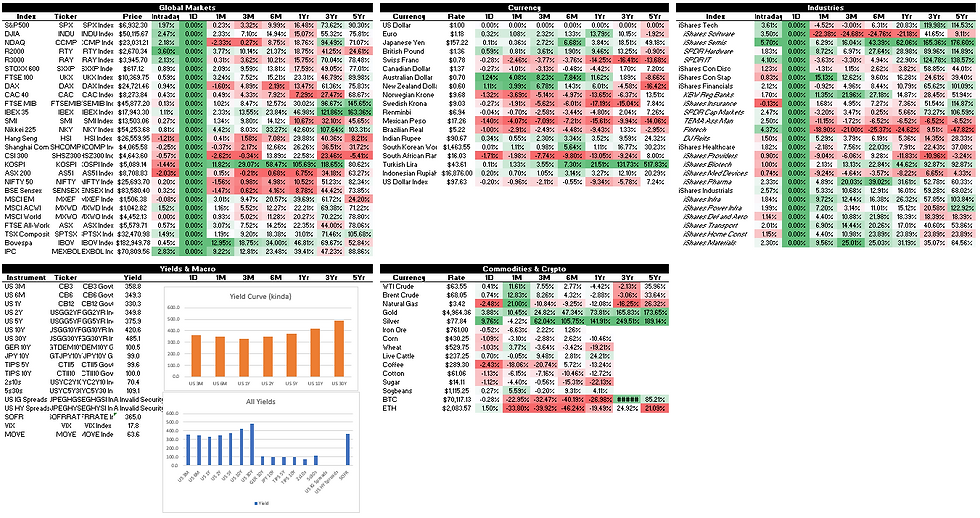

I mentioned last month that I would be taking the time to build out some tools this month. I'm really proud of the dashboard I built using the Bloomberg Plug-In. I'm using it to track names I've diligenced in the past:

Along with keep track of markets generally:

Checking these daily helps me really keep a pulse on the market and has massively aided my learning. Seeing stocks that I've done lots of work on have big moves gives me more points of feedback. Sort of like an LLM. I just want to be trained on what moves stocks.

I've also started jotting down ideas that I want to talk about in these monthly posts. This last month I feel like I've developed increased faith in my circle of competence. I'm pretty good at understanding sentiment around the stocks I follow and am good at thinking independently in gauging the accuracy of that sentiment. I also continue to learn that you can't rent conviction. That's why Abacus will be on the way out soon.

Overall a good month for learning and a fun time to be in markets. They continue to fascinate me more and more. In high school, I always felt like school was a great use of time. I now feel like time spent at school is time not spent working on my ideas and process. I'm fortunate and grateful to have found a craft that demands this level of passion.

Comments