Portfolio Update: March 2025

- Christian Evans

- Mar 18, 2025

- 2 min read

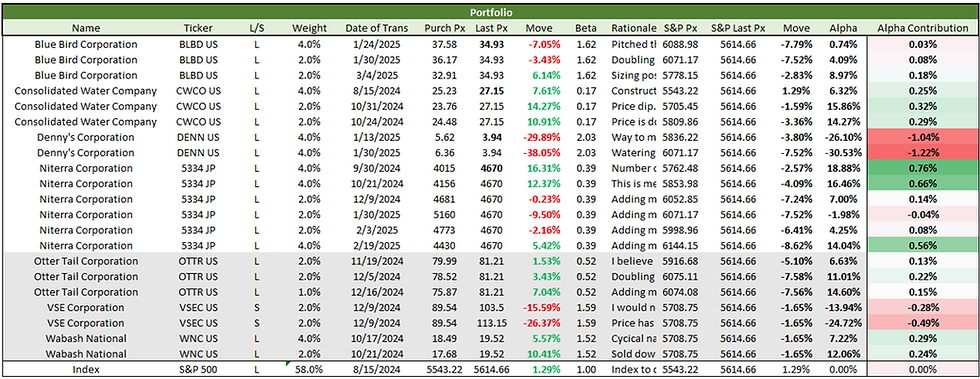

The following is my portfolio as of 3/18/2025:

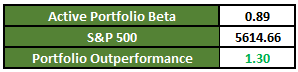

And the following is my outperformance against the S&P 500:

Since my last writing the portfolio has seen a turn. Most of the uptick in performance can be attributed to Niterra gaining back some of the alpha it had lost in January and the overall lackluster performance from the S&P 500. I'm relatively satisfied with the current portfolio and have multiple ideas teed up which I believe will help me diversify the kinds of companies I hold in my portfolio. I'm very close to finishing work on Deckers (NYSE: DECK), and believe I will take a position at the end of this week or the start of next week if my dive on HOKA goes well. I am also working on a pitch for Global-e (NASDAQ: GLBE) for Silver Fund that I think will be added to the portfolio. I don't expect these weights to be any larger than 4-5%, but I do think they will help me get out of more stereotypical value investing. Regardless of if that's the style which is best for me, this is a low stakes environment perfect for experimenting.

The Denny's position has continued to burn a hole in my alpha generation. Without this position, my current alpha would be 3.56 points. Obviously, I think there were some flaws in how I approached Denny's and how I approached their Q4 earnings, but I feel that Denny's is once again undervalued. They have been hammered on all fronts. Egg prices and commodities have hurt the stock. Lackluster guidance and recessionary fears have hurt the stock. Increased store closures have hurt the stock. There are so many issues dragging on the stock that I think people have lost sight of the underlying business. Denny's is not going to go bankrupt soon, and with that being the case it is undervalued at sub-10x p/e. If this appears to be untrue after the next earnings release, it may be time to cut my losses. This Denny's experience has definitely been a lesson in falling knives.

Comments